We’re championing the power of community

Royal Bank of Scotland Community account is available to account holders over 18 who have the right to be self employed in the UK.

To qualify for free banking at least one of the parties named in the application must be an existing Royal Bank personal or business banking customer and your community account's annual credit turnover is less than £100,000. Free banking on everyday transactions means the charges for day to day running of your account (known as your service charges) won’t apply. Charges for unarranged overdrafts, Bankline, international payments and any additional services are not part of the free banking offer. Subject to the terms and conditions of the account, we’ll always give you at least a 60-day notice of any changes to the service charge tariff that will apply to your account before you start to incur charges.

Digital Banking available to customers with a Royal Bank account. App available to customers with compatible iOS and Android devices and a UK or international mobile number in specific countries. Free banking is subject to status. FreeAgent is free subject to client retaining their Royal Bank of Scotland business banking current account. Optional add-ons may be chargeable.

Free accounting software? Yes please.

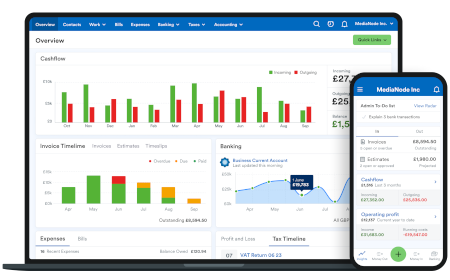

FreeAgent accounting software makes it easy to stay on top of your business finances and has been named the Friendliest Software of the Year*. As a Royal Bank business current account holder, you can access this software for free** for as long as you retain your bank account. Key features include:

Invoices, expenses and bank accounts in one place

Cashflow overview and 90-day cashflow forecast

Tax Timeline and Making Tax Digital-compliant tax returns

* Institute of Certified Bookkeepers Luca Awards 2022.

**Optional add-ons may be chargeable.

This account in detail…

Features OpenClose

Contactless debit card

Chequebook and paying in book

Authorise signatories

Benefits OpenClose

Managing cashflow is easy

Free banking on everyday transactions

Charges OpenClose

Useful info about this account

Switch to Royal Bank

The Current Account Switch Service will do all the work when it comes to switching, moving everything across from your old account all within 7 business days, including Direct Debits and standing orders. All you need to do is tell us the details of your old bank account and when you want the Switch to start.

Current Account Switch Guarantee (PDF, 60KB)

A Guide to Switching Current Accounts (PDF, 532KB)

Social and Community Capital

We’re sure you’ll make a big positive impact, but sometimes it's difficult to get the finance you need to grow. We can offer support and alternative funding.

Security may be required. Product fees may apply. Over 18s only. Subject to status, business use only.

Boost your business

Ready to take your business to the next level? Our Local Enterprise Managers will help boost your connections, your skills and your knowledge.